Tackling Impulse Buying: Strategies to Curb Spending Habits

We’ve all been there: standing at the checkout counter, staring at an item we didn’t plan on buying, but suddenly feel compelled to own. It’s called impulse buying, and it can wreak havoc on our financial well-being. Luckily, there are strategies we can employ to curb these spending habits and take control of our impulses.

First and foremost, it’s important to understand the psychology behind impulse buying. Often, we purchase things on impulse because we believe they will bring us happiness or fill a void in our lives. Advertisements and persuasive marketing tactics also play a significant role in convincing us that we need certain products. Recognizing these triggers is the first step towards curbing our impulse buying tendencies.

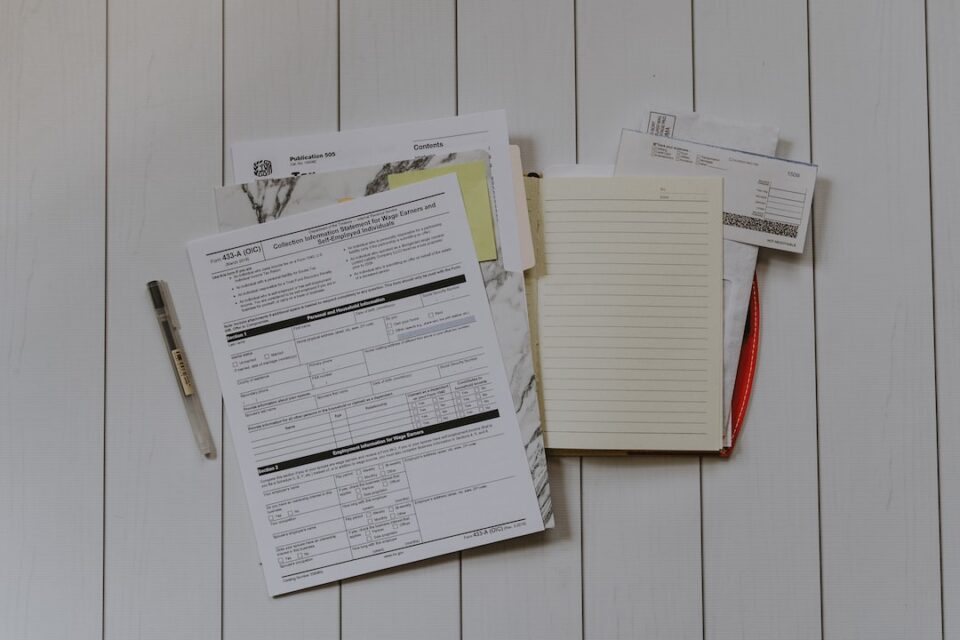

One effective strategy to tackle impulse buying is creating a budget and sticking to it. By setting a limit on how much you can spend each month, you can avoid unnecessary purchases that may not align with your financial goals. Prioritize your needs and allocate a certain amount for discretionary spending, but always remember to stay within your limit.

Another helpful technique is to implement a waiting period before making any non-essential purchases. When you come across an item you feel tempted to buy, take a step back and give yourself some time to think it over. Often, this waiting period will allow you to reassess whether the purchase is truly necessary or just a fleeting desire. Additionally, during this waiting period, you can research the product thoroughly, read reviews, and compare prices to ensure you are making an informed decision.

Creating a shopping list and sticking to it is another effective way to curb impulse buying. When you go to the store with a specific plan in mind, you are less likely to be swayed by enticing displays and discounts. By staying focused on what you need, you can avoid unnecessary purchases and save money in the process.

It’s also crucial to identify and avoid your triggers. If you find yourself constantly succumbing to the urge to shop online, consider uninstalling retail apps or unsubscribing from promotional emails. If visiting malls or stores tempts you, find alternative activities that can keep you occupied and away from shopping temptations. Identify healthier ways to cope with any emotions that may trigger your impulse buying, such as going for a walk or engaging in a hobby.

Finally, cultivating a mindfulness practice can be beneficial in curbing impulse buying. By practicing mindfulness, you become more aware of your thoughts, feelings, and impulses. This self-awareness can give you the ability to recognize and control your impulses before they lead to unnecessary purchases.

While taming impulse buying habits may require some patience and effort, the long-term benefits are worth it. By implementing these strategies, you can regain control over your spending habits, save money, and ultimately achieve your financial goals. So, next time you find yourself faced with the urge to buy something impulsively, take a step back and ask yourself: is this something I truly need or just a passing desire?